Washington, D.C. : On May 22, 2025, the U.S. House of Representatives narrowly approved the One Big, Beautiful Bill Act (OBBBA), a comprehensive tax and spending package promoted by President Donald Trump.

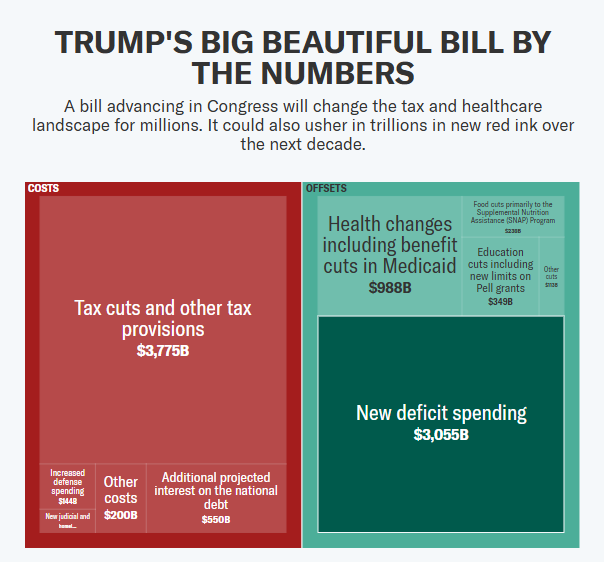

The bill is expected to increase the federal deficit by nearly $3.8 trillion over the next ten years.

Key Changes for Taxpayers

The legislation expands the child tax credit to $2,500 per child through 2028, before reducing it to $2,000 afterward. It raises the state and local tax (SALT) deduction cap from $10,000 to $40,000 for taxpayers making less than $500,000, mainly benefiting residents of states with high taxes.

The tax on remittances sent abroad is lowered from 5% to 3.5%, starting January 2026. Additionally, the bill introduces the “MAGA” savings account, providing $1,000 per child for newborns between 2025 and 2028.

Provisions Affecting Businesses

Corporate tax cuts from the prior Tax Cuts and Jobs Act are extended, maintaining the corporate tax rate at 21% and preserving bonus depreciation benefits.

The deduction for qualified business income is increased from 20% to 22%, benefiting small business owners.

New taxes on private university endowments are also part of the bill, potentially impacting these institutions’ finances.

Changes to Healthcare and Social Programs

The bill implements work requirements for Medicaid recipients, including those above the federal poverty line, and introduces stricter eligibility verification processes.

It shifts some funding responsibility for the Supplemental Nutrition Assistance Program (SNAP) to states, requiring them to cover 5% of benefit costs and 75% of administrative expenses, which could place additional strain on state budgets.

Environmental and Security Measures

Many green energy incentives, such as tax credits for electric vehicles and renewable energy projects, are rolled back.

The bill allocates an additional $150 billion for defense spending, focusing on technologies like uncrewed drones, and designates $70 billion for enhanced border security.

Political Context and Next Steps

The bill passed largely along party lines, with a slim one-vote margin. Representative Andrew Garbarino notably missed the vote after falling asleep during an overnight session, drawing criticism.

The legislation now moves to the Senate, where its future remains uncertain amid concerns about the rising federal deficit and impacts on vulnerable populations.

Experts estimate the bill could add $4.6 trillion to the deficit over the next decade if all provisions are enacted.